Combat the Effects of High Inflation on Donors’ 2023 Giving

Please enter your information to receive this free article.

After low inflation for more than three decades, many Americans are learning for the first time the pernicious effects of gradual higher inflation on their everyday lives. Leading many news stories are record prices to fill up our cars and the ripple effects of high fuel costs on most items we purchase for daily life. In response to higher inflation over the past 14-plus months, many Americans have changed their spending and saving habits.

This begs the question: What will be the impact of high inflation on charitable giving? And, if donors give less in high inflationary periods, then what activities should nonprofit leaders and gift officers do to stem donors’ decline in giving? But first, it is important to understand the context in which we find ourselves.

According to Giving USA’s 2022 Annual Report, giving remained strong last year for a total of $484.85 billion, which was a 4 percent increase in current dollars. However, in inflation-adjusted terms, giving declined by 0.7 percent. While the top-line number was robust, nonprofit leaders should prepare for the possibility of a decline in giving during inflationary times.

Inflation was at a 39-year high of 7 percent at the end of 2022, and the inflation rate continued to climb every month in 2022 for a high of 9.06 percent in June before a decline in the final months of 2022. As you know, high inflation reduces one’s purchasing power and thus decreases one’s income. When donors have less income, they are inclined to give less, particularly small-dollar donors. High inflation also causes many donors to focus their attention on asset preservation and strategies to help maintain long-term financial independence.

The 1970s was a high-inflationary decade that saw year-over-year inflation spikes not dissimilar to 2021 and 2022. During the high-inflationary period of 1972-1975, in inflation-adjusted terms, giving fell by almost 9 percent. This data point alone should encourage nonprofit leaders and gift officers to modify their fundraising practices in the near term as inflation persists.

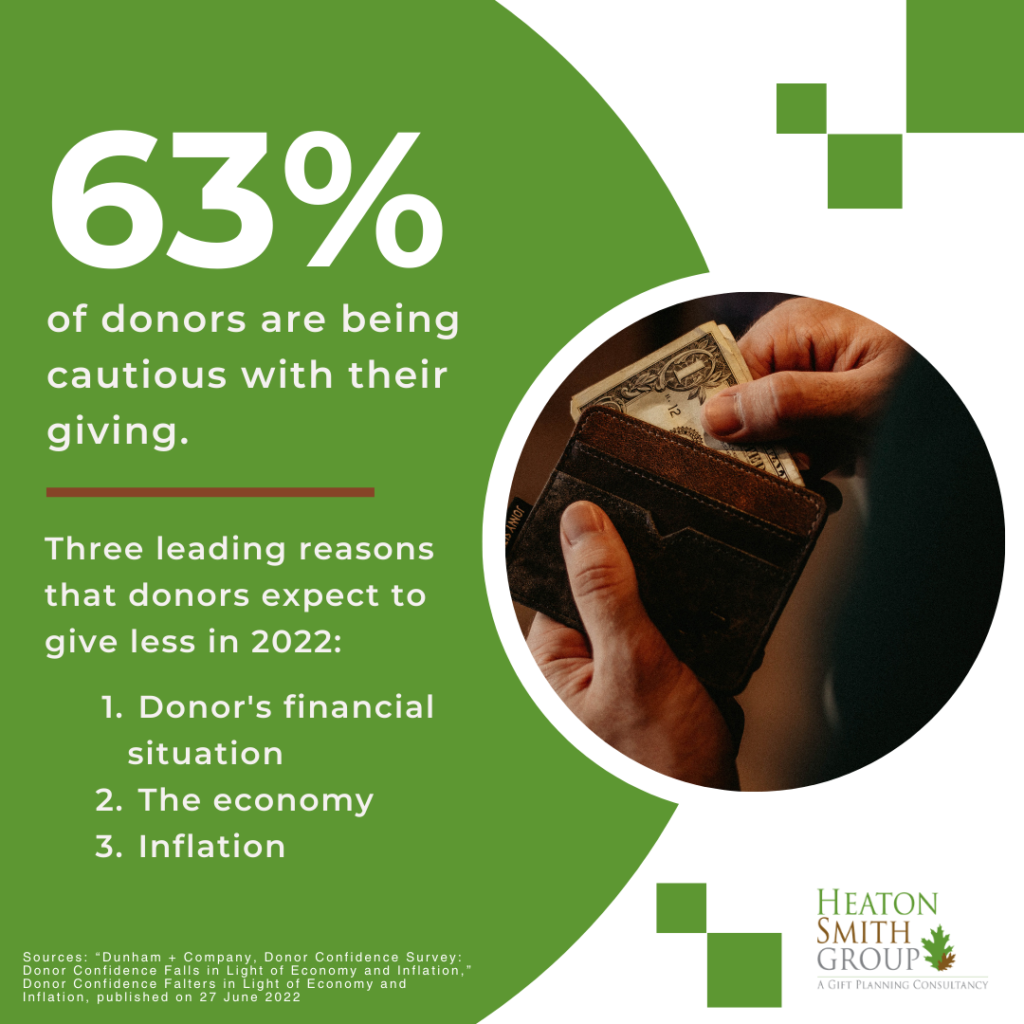

Importantly, high inflation can have significant psychological effects on donors, which impact their willingness to make gifts, in general, and can impact the size of their gifts, specifically. Dunham + Company publishes an annual donor confidence survey and released its latest findings on June 27, 2022. The report found that 63 percent of donors said that they were being cautious with their giving, which is up from 59 percent the previous year. Interestingly, the three leading reasons that donors expected to give less in 2022 were their financial situation (41 percent), the economy (13 percent), and inflation (35 percent).

The same report found that 53 percent of donors are unsure about the economy, or they believe that it will decline in the coming year, compared to 36 percent expressing the same sentiments about the economy last year. This should come as no surprise to any reader, given that the University of Michigan Consumer Price Index is at an all-time low of 50 percent, which is a year-over-year decline of 41.5 percent. The decline in the stock market in 2022, joined with high inflation, has certainly impacted donors’ confidence in the economy for the near term. It is understandable that a majority of donors express caution regarding their giving.

While the previous data indicates a bumpy ride ahead for giving in inflationary times, nonprofit leaders and gift officers must proactively try to stem the decline in giving to their organizations. The following are seven activities to implement to combat the negative impact of inflation on giving:

Every donor with whom I met in 2022 has discussed their concerns about the effects of high inflation on their purchasing power, their families, and their philanthropy. The only comparison would be the Great Recession. During that two- to three-year period, the correction of the real estate and financial markets was the focus of all donor conversations. High inflation is on the minds of your donors, even those who are wealthy.

If you continue “business as usual,” then your organization will experience a decline in giving this year.

However, if you focus on the above activities and offer the best philanthropic solutions for each donor, then you will help limit the effects of 40- year high inflation on your organization.

Sources:

“Giving USA Foundation: Giving USA 2022.” p. 22

“American Inflation Rates,” USA Inflation Summary for May 2022, last modified June 10, 2022 https://www.rateinflation.com/inflation-rate/ usa-inflation-rate/

“USA Inflation Summary for May 2022,” last modified June 10, 2022 https://www.rateinflation. com/inflation-rate/usa-inflation-rate/

“US Inflation Rate by Year from 1929 to 2023,” updated May 17, 2022 https://www.thebalance.com/u-s-inflation-rate-history-by-year-andforecast-3306093

“Dunham + Company, Donor Confidence Falters in Light of Economy and Inflation,” published on June 27, 2022 https://www.dunhamandcompany.com/wp-content/uploads/2022/06/Donor-Confidence-Falters-in-Light-of-Economyand-Inflation-FINAL.pdf?goal=0_b82a25e92a-45edb4e02e-429386029

“Donor Confidence Falters in Light of Economy and Inflation,” p. 2 https://www.dunhamandcompany.com/wp-content/uploads/2022/06/Donor-Confidence-Falters-in-Light-of-Economyand-Inflation-FINAL.pdf?goal=0_b82a25e92a-45edb4e02e-429386029

“Donor Confidence Falters in Light of Economy and Inflation,” p. 3 https://www.dunhamandcompany.com/wp-content/uploads/2022/06/Donor-Confidence-Falters-in-Light-of-Economyand-Inflation-FINAL.pdf?goal=0_b82a25e92a-45edb4e02e-429386029

“Donor Confidence Falters in Light of Economy and Inflation,” p. 3 https://www.dunhamandcompany.com/wp-content/uploads/2022/06/Donor-Confidence-Falters-in-Light-of-Economyand-Inflation-FINAL.pdf?goal=0_b82a25e92a-45edb4e02e-429386029

“Surveys of Consumers: University of Michigan.” June 2022 http://www.sca.isr.umich.edu

“Fortune: Millennials’ wealth more than doubled to over $9 trillion since the pandemic began, but baby boomers are still worth almost 8 times as much.” https://fortune.com/2022/03/22/millennial-wealth-doubles-during-pandemic-9-trillion-boomers/

“Donor Confidence Falters in Light of Economy and Inflation,” p. 2 https://www.dunhamandcompany.com/wp-content/uploads/2022/06/Donor-Confidence-Falters-in-Light-of-Economyand-Inflation-FINAL.pdf?goal=0_b82a25e92a-45edb4e02e-429386029

“Giving USA Special Report: Leaving a Legacy,” p. 60, Giving USA Foundation, 2019

“Giving USA Special Report: Leaving a Legacy,” p. 19, Giving USA Foundation, 2019

Your message was successfully sent

Our customer support manager or technical department representative will contact you within 24 hours.

Please enter your information to receive this free article.