Planned Giving in the African American Community

The African American community has a strong tradition of giving its time, talent, and treasure to others. Historically, these gifts have gone to churches, a donor’s alma mater, and civic organizations such as the Urban League and NAACP.

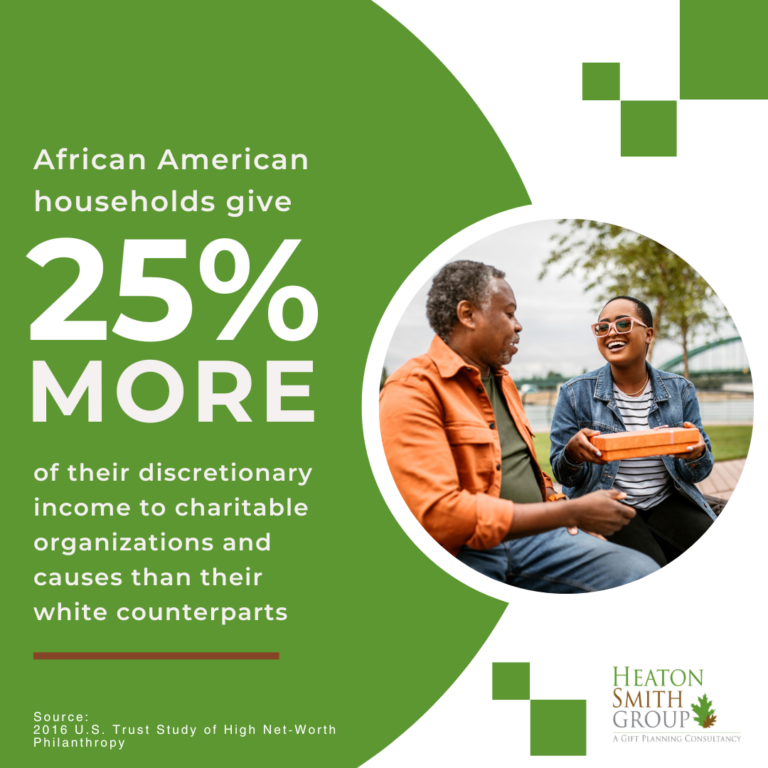

According to the 2016 U.S. Trust Study of High Net-Worth Philanthropy¹, African American households give 25% more of their discretionary income to charitable organizations and causes than their white counterparts.

Despite this culture of giving, when I first mention planned giving to many individuals, they initially balk at the idea due to a belief that it is only for extremely wealthy donors. However, a planned gift can simply be any major gift made during an individual’s lifetime and/or at their death as part of their overall financial or estate plan. These gifts include bequests, qualified charitable distributions (QCDs), beneficiary designation of retirement assets or life insurance policies, donor-advised funds, and more.

- Creating a Legacy

Most people want to be remembered in a positive way and leave something behind that will have lasting impact. A planned gift provides an opportunity to create a legacy for future generations. In addition, many African Americans give because they have seen their parents and grandparents do so; according to the 2016 U.S. Trust Study of High Net-Worth Philanthropy, many African Americans surveyed stated that they had a family tradition of giving. Planned gifts continue this legacy for generations to come. - Giving the Maximum to Family While Minimizing Taxes

Planned gifts can help individuals minimize their federal and state income and capital gains taxes. For example, individuals can contribute real estate and stock to charitable institutions, receive a charitable deduction, and in most circumstances, avoid paying capital gains tax on the transfer. In addition, heirs can avoid taxes on charitable gifts made from taxable retirement accounts upon the account holder’s death. Importantly, there are tax advantages to gifting certain assets to heirs and to charities. For example, heirs avoid ordinary income tax when taxable retirement account holders leave those assets to charities instead of heirs. Charitable gifts made from taxable retirement accounts are not subject to ordinary income taxes. Supporting Important Causes

Planned giving allows individuals to support their favorite charitable causes in perpetuity through endowments. For donors that endow scholarships at higher education institutions, some direct their gifts toward first-generation African Americans attending college while others may direct their scholarships to need-based students. Donors determine the long-term impact they want to have on the African American community, and with input from gift officers, design their gift accordingly.

Planned gifts also allow individuals to make larger gifts than they might normally think possible by utilizing a wide range of financial assets, such as a beneficiary designation in a life insurance policy or retirement account, real estate, or tangible personal property. According to Hugh B. Price, former president of the National Urban League, “Black philanthropy provides the indispensable financial foundation that guarantees the survival of vitally important nonprofit institutions while also fueling their ascent to new heights of impact and excellence.”- Reducing the Racial Wealth Gap

Most African Americans give to institutions, causes, and grassroots organizations that directly support the African American community. Supporting these causes through planned gifts help sustain organizations working to improve a variety of outcomes for African Americans. In addition, certain planned gift instruments allow families to retain the majority of their assets and accumulate intergenerational wealth. Particular charitable trusts can preserve assets for family long-term but provide current income to a nonprofit in the interim, and life income gifts can create an income stream for beneficiaries and thus help to reduce the racial wealth gap in the US.

The tradition of charitable giving, even among individuals with modest means, is alive and well in the African American community. By pooling resources through giving circles, churches, social clubs, and professional associations, African Americans have created unique systems of giving that have redefined philanthropy in America.

For more information about how to establish a planned giving program for your institution, please contact Tamisha Keith at tamisha@heatonsmithgroup.com.