Combat the Effects of High Inflation on Donors’ 2023 Giving

Please enter your information to receive this free article.

Author: Dave Smith, CAP®

Founder & CEO

Heaton Smith Group

While the 1% has captured the public’s imagination, there is a broader narrative about wealth and affluence in America that many overlook. For 2024 and beyond, let’s shift the spotlight to realize the significant gift planning opportunities that exists with donors in the top 5% and 10% wealth households. The data are eye-popping!

Historically, planned giving programs have often taken a one-size-fits-all approach, typically emphasizing bequests, beneficiary designations, and Charitable Gift Annuities (CGAs) to a general planned giving prospect donor base. However, this strategy may not fully resonate with donors who have a deep connection to your organization and significant financial resources. Tailoring your organization’s strategy to focus on gift planning, which encompasses a more personalized engagement and a wider array of gift options, could better meet the needs of high-affinity, high-capacity donors and significantly increase your fundraising potential.

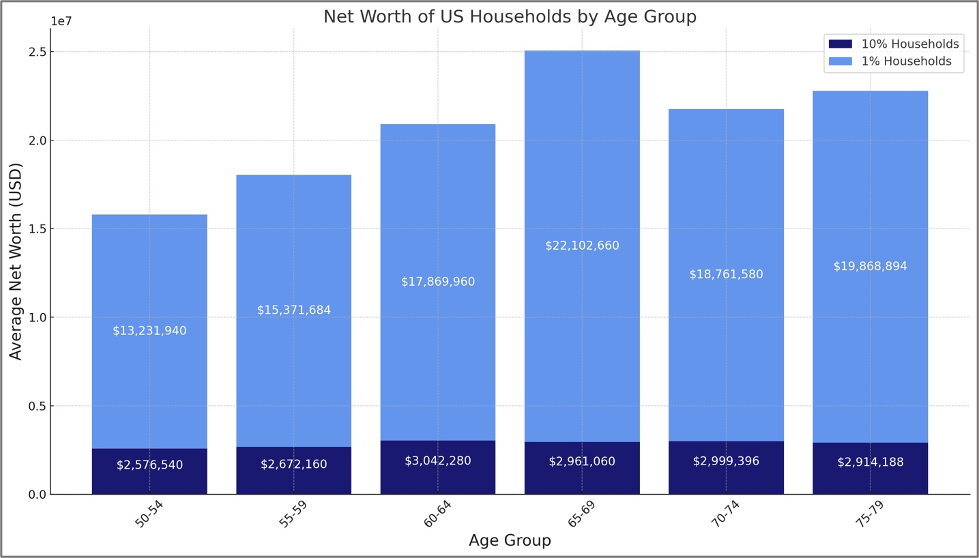

The following graph illustrates updated net worth figures for Americans segmented into age bands. (Board of Governors of the Federal Reserve, 2023) The data underscores the opportunity for gift officers to engage younger, high affinity, higher-capacity donors in gift planning conversations, in addition to older donors. The compelling data reveal that affluence in America extends to the top 10% households based on their average net worth beginning at age 50. These figures would be larger still if recalculated in December 2023 given the notable gains in the US stock exchanges last year.

Based on other data, to determine the average net worth of 5% households in the US, one can double the values for 10% household wealth in each age band. For example, donors aged 50-54 in the 5% household wealth category have an average net worth of approximately $5,000,000. This begs the question: Why would a gift officer not have gift planning conversations with high affinity, higher-capacity donors beginning in their early fifties? After all, many younger and affluent donors want to help “all they can, when they can.”

Thus, it’s not just the 1% households in America who are wealthy. Would donors in their 50s and 60s worth $2.5 – 2.9 million self-identify as wealthy? For most, the answer is a resounding no. However, these donors are affluent, many remain in the workforce, and they continue to accumulate additional wealth.

https://www.federalreserve.gov/econres/scfindex.htm

The pool of higher-capacity donors in the US is remarkably large, which is promising for the nonprofit sector. Is your organization effectively engaging high affinity, higher-capacity donors in strategic and donor-centric gift planning conversations? Are you facilitating gifts of assets, blended gifts, and charitable trusts from high-capacity donors? If not, then please let us know if Heaton Smith can help you convert your program from a planned giving framework to a more tailored gift planning model and one that meets the needs of high affinity, higher-capacity donors – even those in their 50s and 60s.

Dave Smith

dave@heatonsmithgroup.com

Follow us on LinkedIn to receive the last blog posts.

https://www.linkedin.com/company/heaton-smith-group